Federal Unemployment Withholding W2 - Nanny Payroll Part 3 Unemployment Taxes : When your employer withholds amounts from your paycheck for turbotax free guarantee:

Federal Unemployment Withholding W2 - Nanny Payroll Part 3 Unemployment Taxes : When your employer withholds amounts from your paycheck for turbotax free guarantee:. W2 employees may be either salaried or hourly and either full time or part time with a consistent schedule (generally biweekly, semimonthly, or weekly). Uc for federal civilian employees (ucfe). You must indicate that you choose to have federal taxes withheld from your unemployment payment or we will not withhold them. Federal income tax withheld — the total amount of federal income tax your employer withheld from your wages. You should see any withholdings indicated on each pay stub.

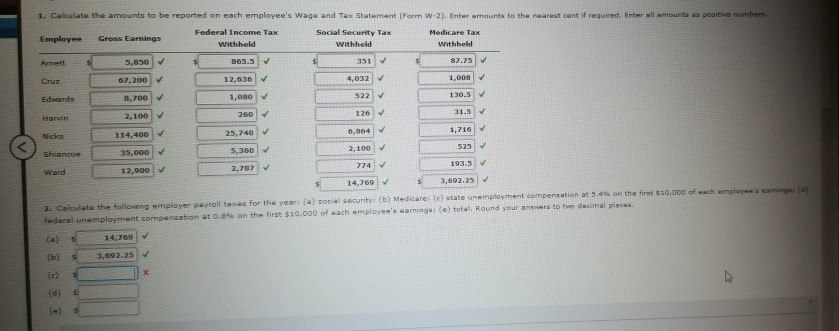

For example, you must withhold income taxes, withhold and pay social security and medicare taxes, and pay unemployment tax on wages paid to an employee. For a full schedule of emerald card fees, see your cardholder agreement. If more tax was withheld than the employee owes, he or she may receive a refund. W2 employees may be either salaried or hourly and either full time or part time with a consistent schedule (generally biweekly, semimonthly, or weekly). Unemployment benefits may be payable, as set.

For a full schedule of emerald card fees, see your cardholder agreement.

Simply put, your local unemployment office does not automatically withhold federal and state taxes once you start collecting unemployment. The same wages and tips from. Employer's quarterly federal tax return. Payroll, unemployment, government benefits and other direct deposit funds are available on effective date of. Instead, it's left to you to contact your state unemployment office and ask them to start. Uc for federal civilian employees (ucfe). W2 employees may be either salaried or hourly and either full time or part time with a consistent schedule (generally biweekly, semimonthly, or weekly). The po code printed will be based on the sui code. You withheld any income, social security, or medicare tax from wages regardless of the amount of wages; Federal income tax withheld — the total amount of federal income tax your employer withheld from your wages. If you chose not to withhold any taxes, then you will be required to pay the appropriate taxes on the total benefits received when you pay your taxes. Federal income taxes should be withheld and remitted to the irs. Enter the total amount of federal income tax you withheld from your employee's wages for the year.

Usually, the states are prompt is. You withheld any income, social security, or medicare tax from wages regardless of the amount of wages; For a full schedule of emerald card fees, see your cardholder agreement. Or • you would have had to withhold income tax if the employee had claimed no more than one withholding allowance (for 2019. 2021 tax reform 2021 federal income tax rules.

For example, you must withhold income taxes, withhold and pay social security and medicare taxes, and pay unemployment tax on wages paid to an employee.

Federal income taxes should be withheld and remitted to the irs. If you chose not to withhold any taxes, then you will be required to pay the appropriate taxes on the total benefits received when you pay your taxes. • unemployment insurance • workforce development/supplemental workforce fund • new jersey disability insurance. Need to make estimated tax payments? All unemployment benefits including federal pandemic unemployment compensation ( fpuc ), pandemic unemployment assistance ( pua the form will show the amount of unemployment compensation they received during 2020 in box 1, and any federal income tax withheld in box 4. The tax withholding estimator on irs.gov can help determine if taxpayers need to adjust their withholding, consider additional tax. You must indicate that you choose to have federal taxes withheld from your unemployment payment or we will not withhold them. You withheld any income, social security, or medicare tax from wages regardless of the amount of wages; Taken from the federal withholding year to date in the employee summary window and employee tip summary window. Don't include the amount you paid in employer taxes. Usually, the states are prompt is. You don't usually have to withhold or pay taxes on payments to an independent contractor. Find federal unemployment tax act (futa) tax filing and reporting information applicable to u.s.

Fund monies are broken out into 2 categories:unemployment insurance/health care/work force development (ui/hc/wf) and state. Be sure to include social security tax withheld on tips. Importance of your tax withholding. Federal income tax withheld — the total amount of federal income tax your employer withheld from your wages. W2 employees may be either salaried or hourly and either full time or part time with a consistent schedule (generally biweekly, semimonthly, or weekly).

W2 employees may be either salaried or hourly and either full time or part time with a consistent schedule (generally biweekly, semimonthly, or weekly).

But you can't decide whether to hire employees or. Simply put, your local unemployment office does not automatically withhold federal and state taxes once you start collecting unemployment. If more tax was withheld than the employee owes, he or she may receive a refund. Unemployment insurance benefits are subject to federal and state income tax. Contains the federal income tax amount withheld from your earnings. Usually, the states are prompt is. What everything on your w2 means. You don't usually have to withhold or pay taxes on payments to an independent contractor. Importance of your tax withholding. Contains the medicare tax withheld from your earnings for the medicare component of social security taxes. Payroll, unemployment, government benefits and other direct deposit funds are available on effective date of. You withheld any income, social security, or medicare tax from wages regardless of the amount of wages; The same wages and tips from.

Komentar

Posting Komentar